Welcome! Here you can find my published research as well as work in progress, various datasets and codes.

Borrower-Based Macroprudential Measures and Credit Growth: How Biased is the Existing Literature?

We collected more than 700 estimates from 34 studies on the effect of borrower-based measures (LTV, DTI, DSTI) on bank loan provision.

On average, the introduction or tightening of borrower-based measures reduces annual credit growth by 1.6 pp.

The existing literature exhibits a strong publication bias, particularly against positive and statistically insignificant estimates.

The bias-corrected coefficient is about half the size of the uncorrected mean of the collected estimates, but remains safely negative.

Further, we find that differences in the literature are best explained by model specification, estimation method, and the underlying data characteristics.

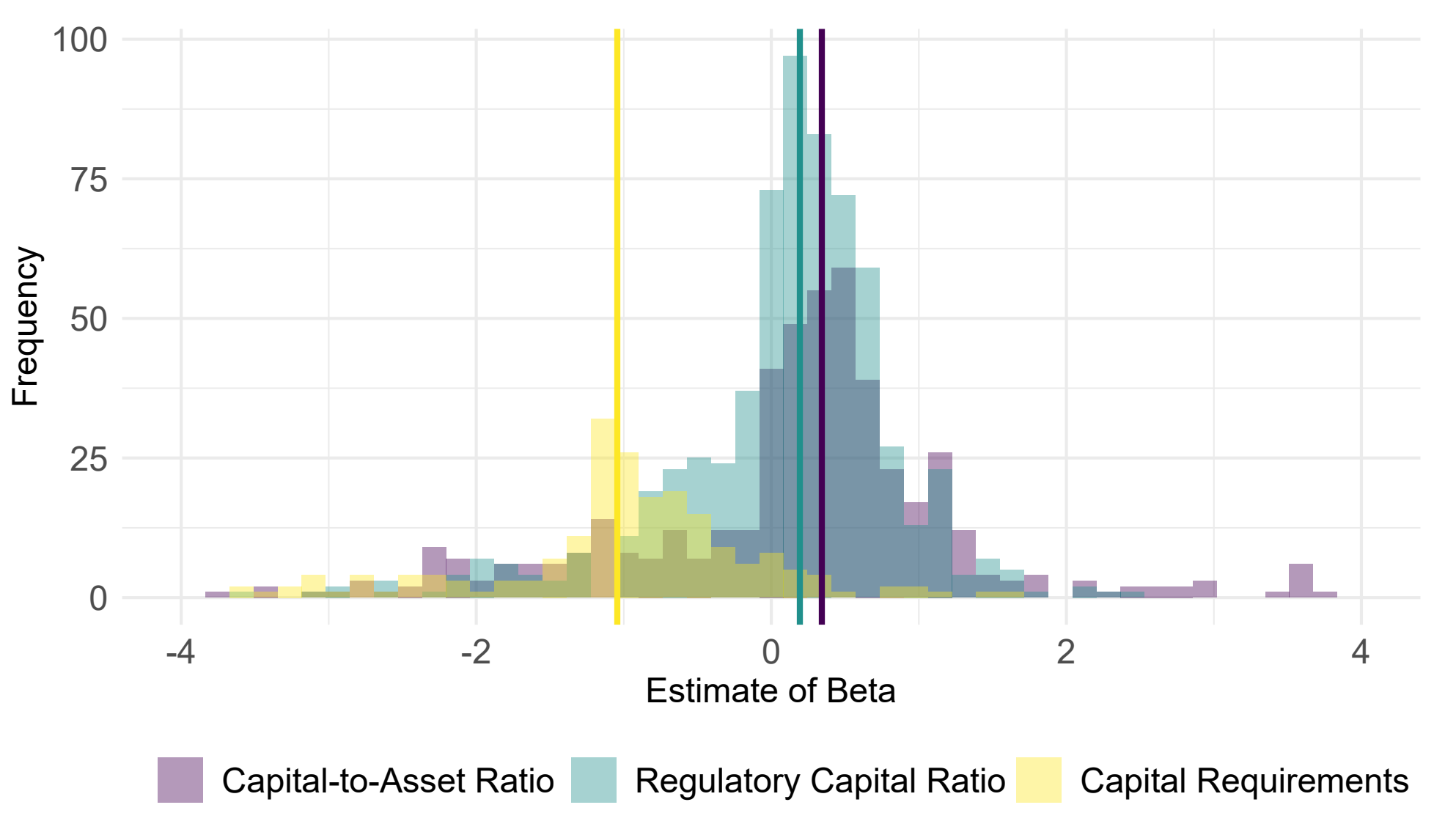

What is the effect of a 1 pp increase in the capital ratio and capital requirements on annual credit growth? About 1,500 estimates say, "It depends".

The effect of a 1 pp increase in the capital (regulatory) ratio is around 0.3 pp, while the effect of the increase in capital requirements is about -0.7 pp, after accounting for publication bias.

We show that the effect changes over time, reflecting the post-crisis period of increasingly demanding bank capital regulation and subdued profitability.

We also find that the estimates are significantly affected by the researchers' choice of empirical approach.

Media, blog posts

Should central banks favour the objective of financial stability or the objective of price stability?

Blog post summarizes the results of a survey among academics and central bankers, in which they answered questions about the interaction and coordination of monetary and macroprudential policy.

— cnBlog (June 26, 2021)

How do central banks collaborate in the field of research?

Central banks form a dense and constantly growing network of co-authorship links. This may to a large extent reflect the increasing amount and scope of central banks’ duties and the growing interconnectedness of world economies and financial systems.

— cnBlog (May 17, 2021)

Research in European and US Central Banks: Differences and Similarities

Research in central banks is important for expanding the knowledge base that central banks can draw on when making policy decisions. How successful are the world's central banks in this?

— cnBlog (April 22, 2021)

What are the risks of a prolonged period of low interest rates?

Mainly in Europe, monetary policy remained highly accommodative long after the Global Financial Crisis had subsided and many economies had returned to economic expansion. What are the consequences?

— cnBlog (January 25, 2021)

How to Organize Research in Central Banks: The Czech National Bank’s Experience

On the importance of in-house research in central banks and the CNB’s experience.

— cnBlog (August 10, 2020)

Too Much of a Good Thing? Households’ Macroeconomic Conditions and Credit Dynamics

Blog post summarizes the findings of two research articles on the link between the macroeconomic conditions faced by households and their demand for credit.

— cnBlog (March 9, 2020)

How to consistently model the financial cycle?

Blog post summarizes the findings of research paper introducing macro-financial variables into a semi-structural model of the Czech economy.

— cnBlog (January 31, 2020)

Banks’ Credit Losses and Provisioning over the Business Cycle: Implications for IFRS 9

Blog post summarizes the findings of research paper on the procyclicality of banks’ credit losses and discusses the implications for provisioning for exposures in stage 3 under IFRS 9.

— cnBlog (January 24, 2020)